Expansão internacional no Brasil: por que marcas globais estão ampliando seus investimentos

Nos últimos anos, uma tendência vem se consolidando no varejo internacional: o Brasil deixou de ser visto apenas como um mercado complexo e passou a

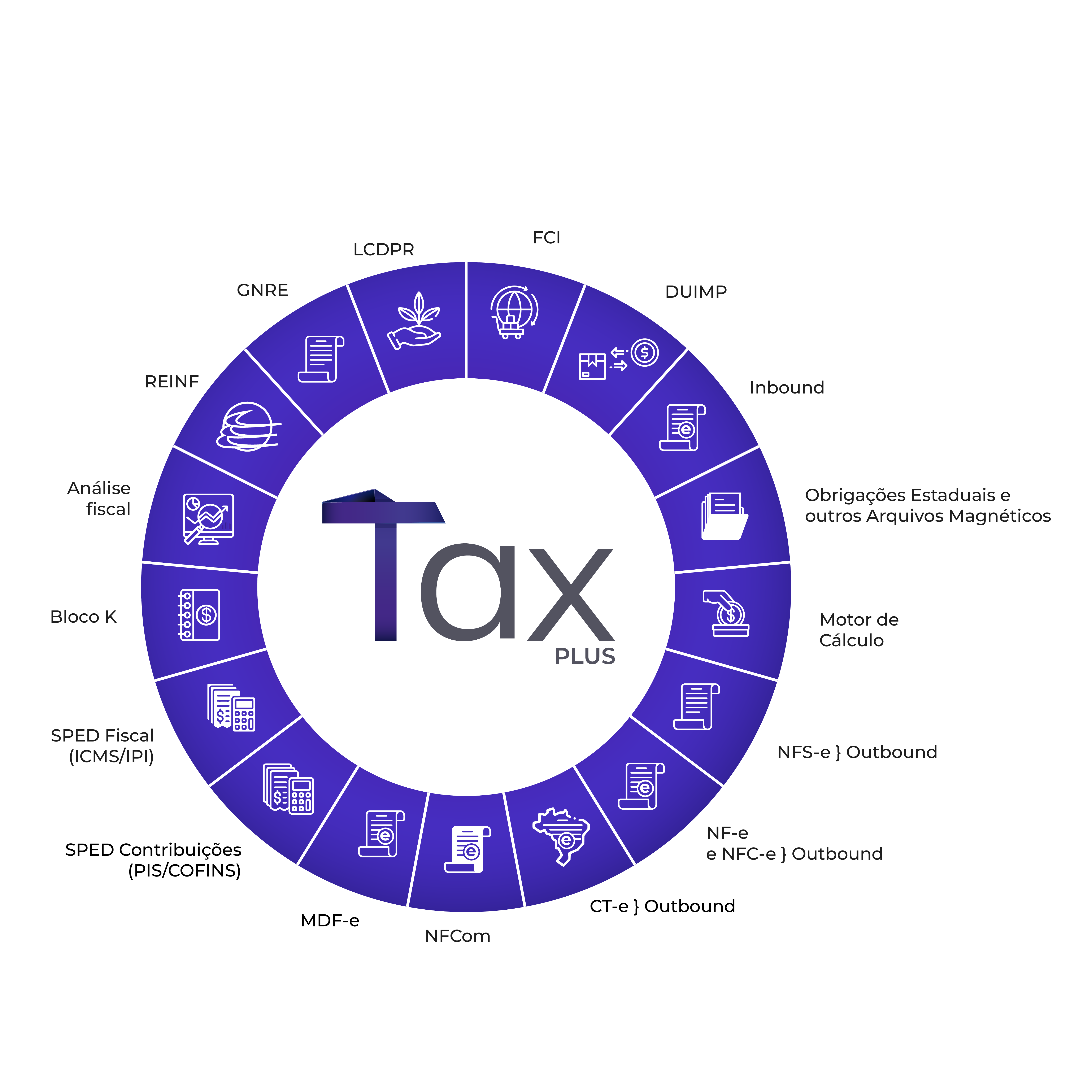

TaxPlus is the ideal solution to simplify tax processes, increase team performance and operational scalability.

Issuance of tax books and obligations (principal and accessory)

Automatic validation of tax documents

Control of invoices for communication and telecommunications

Generation of GNRE guides from any state in Brazil

Automatic and efficient management of electronic invoices

Management of personalized electronic service invoices by municipality

Issuance of tax receipts

Document management for the transportation of goods or merchandise covered by more than one NF-e

Sending employment information in accordance with e-Social

Issuance and signing of all documentation relating to transport activities.

Check out the main new developments in the market

Nos últimos anos, uma tendência vem se consolidando no varejo internacional: o Brasil deixou de ser visto apenas como um mercado complexo e passou a

O ERP Summit se consolidou como o maior evento de software e gestão da América Latina. Mais do que um encontro sobre tecnologia, o evento

A substituição da DIRF já faz parte da realidade operacional das empresas. O envio distribuído de informações por meio do eSocial e da EFD-Reinf deixou de ser transição

+55 62 3637-1774

+55 61 3550-5449

+55 11 3164-0099

Hamburg Avenue, 254 - Block 142 - Garden Europe, Goiânia - GO, 74330-340

Spark Coworking

71936-250