Produtor Rural e a Nota Fiscal no Novo Cenário

A relação entre produtor rural, Nota Fiscal e CNPJ entrou definitivamente no centro das discussões tributárias recentes. Mudanças no modelo de tributação do consumo, avanços

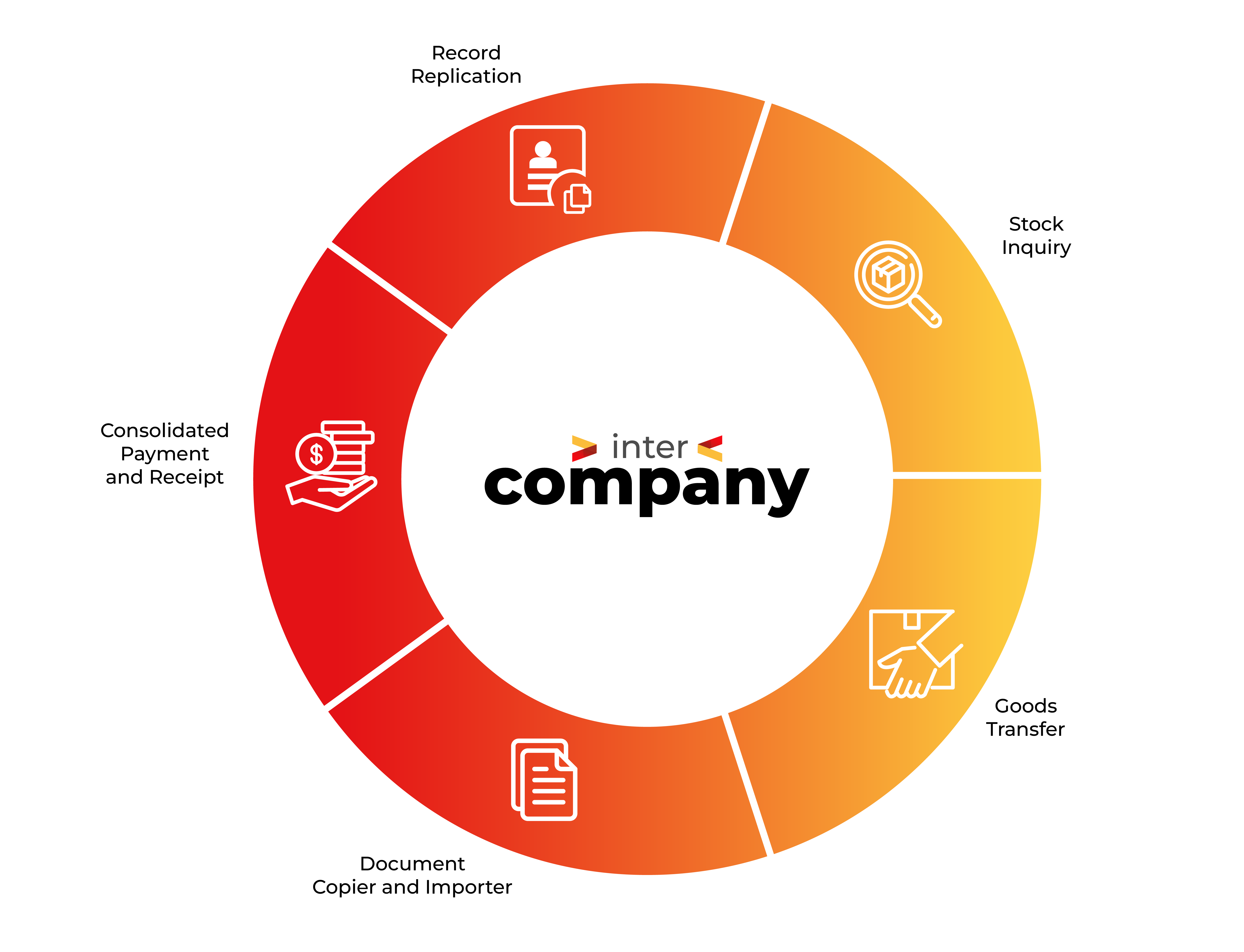

Intercompany optimizes day-to-day processes by integrating the management of information from all your companies in one place, so that people can manage their routines with autonomy and freedom.

Integration of information between different SAP® Business One databases (as long as the companies are located in Brazil).

The consolidation of accounts payable and receivable is carried out on a single screen, which speeds up the financial reconciliation process.

Transaction records are processed in real time, ensuring that information is always up-to-date and accurate.

It allows the transfer of goods between companies and enables them to carry out more efficient control of their stock.

The replication rules configuration is flexible for each type of registration, so that all information is replicated accurately.

Allows companies to copy invoices or orders between themselves. It is possible for a purchase order from company X to be converted into a sales order in company Y.

Check out the main new developments in the market

A relação entre produtor rural, Nota Fiscal e CNPJ entrou definitivamente no centro das discussões tributárias recentes. Mudanças no modelo de tributação do consumo, avanços

Se a sua empresa passou anos “fechando a DIRF” como um grande checkpoint anual, 2026 marca uma virada operacional: a DIRF deixa de ser o

A Reforma Tributária está avançando com mudanças práticas na forma como as empresas vão emitir documentos fiscais, calcular tributos e comprovar operações. Além da legislação, com a nova

+55 62 3637-1774

+55 61 3550-5449

+55 11 3164-0099

Hamburg Avenue, 254 - Block 142 - Garden Europe, Goiânia - GO, 74330-340

Spark Coworking

71936-250